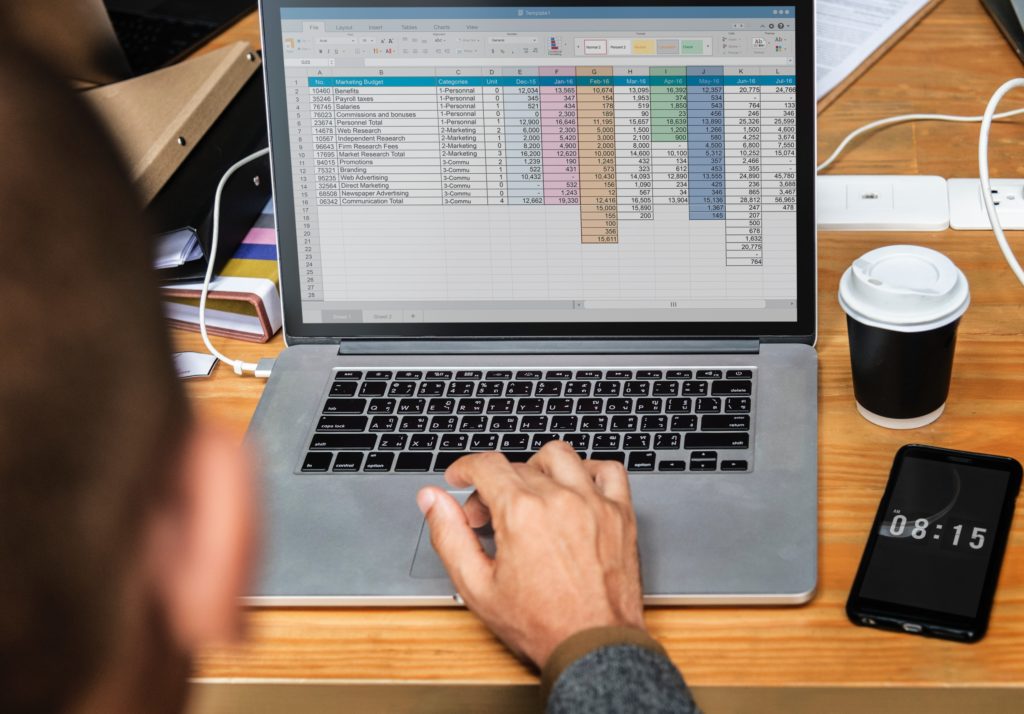

Why You Need More than Just Excel for Budgeting

Did you know that Excel is used in approximately 75% of companies’ budgeting processes? There is no doubt that it is a powerful tool and that spreadsheets can be used for budgeting, but Excel was not designed specifically for this. It is missing some key controls, which end up making the process a long and somewhat complex one. In this blog, we’ll further explore some of the issues associated with budgeting in Excel, and how companies are looking to improve their budgeting process.

One of the most common problems budget contributors face is with manual data entry. Excel is very capable of completing complex calculations, but it does not have a framework that accurately identifies and points out errors within the data set(s). Quite often, manual data entry results in errors such as the duplication of entries, transposition of numbers, added or dropped numbers, etc. Not to mention the sheer amount of time it takes to enter all of this in manually!! Since budgeting is all about your numbers, you can see how manual entry can be dangerous, and how Excel may not be ‘enough’ to ensure what you’re working with is accurate.

Another common problem faced when using Excel to budget is the number of spreadsheets that managers/CFOs have to deal with. For example, if a company has 15 different departments, each is going to build their own budget. That’s at least 15 workbooks/spreadsheets. Then, assume each budget goes through at least 3 variations/versions – the number of workbooks has now increased to 45. Multiple versions and spreadsheets are hard to manage. This makes it harder to track changes and updates, and to build an overall ‘master budget’. Merging all of these spreadsheets causes headaches, which is another reason how Excel limits your ability to build a budget.

One final reason that relying solely on Excel for your budget can be troublesome is that you’ll often be dealing with outdated numbers. Since continuous updating, especially when you rely on manual input, requires great amounts of time, unless you can ensure that time will be spent regularly, you can’t be certain that your numbers are up to date and relevant. This may result in critical budget decisions being made upon numbers that do not accurately represent your organization’s current financial position.

So what is the common theme here? Excel is a powerful tool, but manual data entry and management can be timely and costly. Excel spreadsheets are ideal as a framework for budgeting, but an integrated solution that uses an Excel interface could save you time and money, making your process much more efficient. Having a system that integrates/shares information from a central database would remove the need for manual entry (therefore reducing errors), and would allow you to extract financial information as it is needed and in real time.

At True Sky, we know how important having accurate and up to date numbers is for your budgeting process, and any decisions that may go along with it. Our solution takes the familiar Excel interface, but makes it better. If you’d like to learn more about how True Sky can help you, please get in touch with us today at 1 855 878 3759, or email info@truesky.com.